Many American businesses have been put on hold as the country deals with the worst pandemic in over one hundred years. As the states are deciding on the best strategy to slowly and safely reopen, the big question is: how long will it take the economy to fully recover?

Let’s look at the possibilities. Here are the three types of recoveries that follow most economic slowdowns (the definitions are from the financial glossary at Market Business News):

- V-shaped recovery: an economic period in which the economy experiences a sharp decline. However, it is also a brief period of decline. There is a clear bottom (called a trough by economists) which does not last long. Then there is a strong recovery.

- U-shaped recovery: when the decline is more gradual, i.e., less severe. The recovery that follows starts off moderately and then picks up speed. The recovery could last 12-24 months.

- L-shaped recovery: a steep economic decline followed by a long period with no growth. When an economy is in an L-shaped recovery, getting back to where it was before the decline will take years.

What type of recovery will we see this time?

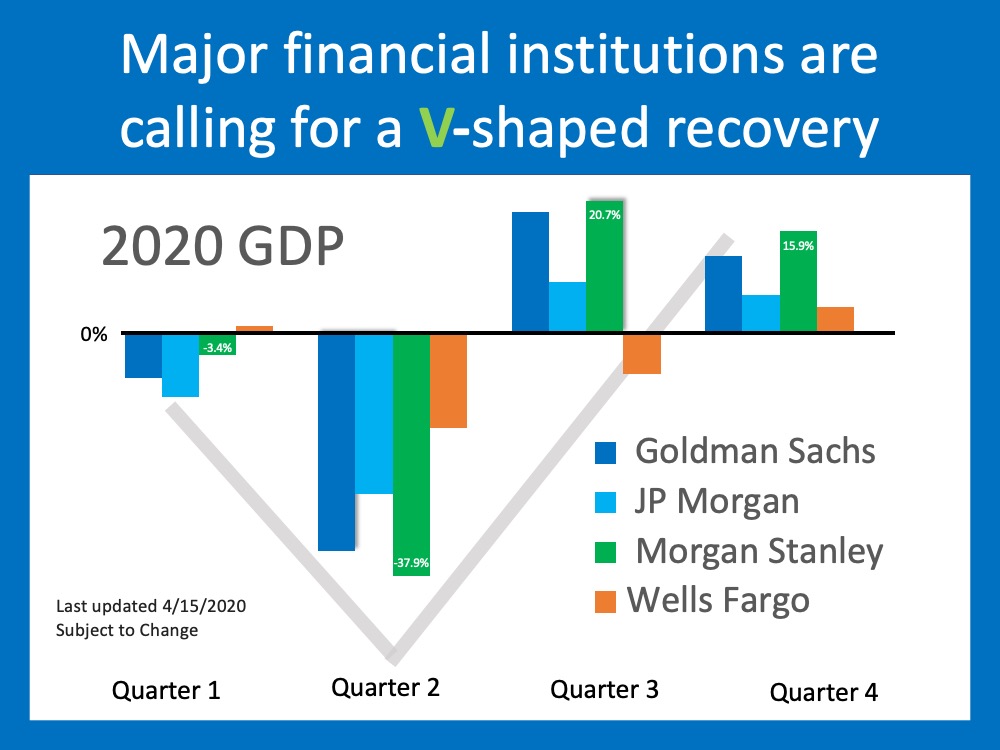

No one can answer this question with one hundred percent certainty. However, most top financial services firms are calling for a V-shaped recovery. Goldman Sachs, Morgan Stanley, Wells Fargo Securities, and JP Morgan have all recently come out with projections that call for GDP to take a deep dive in the first half of the year but have a strong comeback in the second half.

Is there any research on recovery following a pandemic?

There have been two extensive studies done that look at how an economy has recovered from a pandemic in the past. Here are the conclusions they reached:

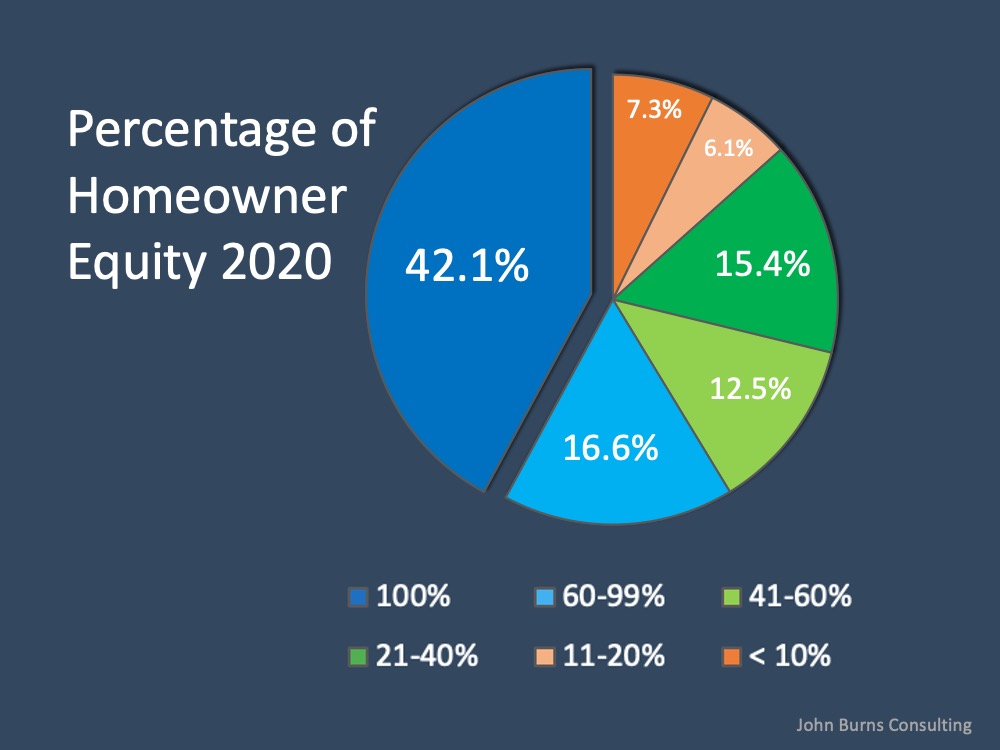

1. John Burns Consulting:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

2. Harvard Business Review:

“It’s worth looking back at history to place the potential impact path of Covid-19 empirically. In fact, V-shapes monopolize the empirical landscape of prior shocks, including epidemics such as SARS, the 1968 H3N2 (“Hong Kong”) flu, 1958 H2N2 (“Asian”) flu, and 1918 Spanish flu.”

The research says we should experience a V-shaped recovery.

Does everyone agree it will be a ‘V’?

No. Some are concerned that, even when businesses are fully operational, the American public may be reluctant to jump right back in.

As Market Business News explains:

“In a typical V-shaped recovery, there is a huge shift in economic activity after the downturn and the trough. Growing consumer demand and spending drive the massive shift in economic activity.”

If consumer demand and spending do not come back as quickly as most expect it will, we may be heading for a U-shaped recovery.

In a message last Thursday, Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank, agrees with other analysts who are expecting a resurgence in the economy later this year:

“We’re forecasting real economic growth of 30% for the U.S. in the 4th quarter of this year and 6.1% in 2021.”

His projection, however, calls for a U-shaped recovery based on concerns that consumers may not rush back in:

“After the steep plunge and bottoming out, a ‘U-shaped’ recovery should begin as consumer confidence slowly returns.”

Bottom Line

The research indicates the recovery will be V-shaped, and most analysts agree. However, no one knows for sure how quickly Americans will get back to “normal” life. We will have to wait and see as the situation unfolds.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link